PPO vs ACA Healthcare A Comparison for Independent Workers

Navigating healthcare options can be a challenge for independent workers, freelancers, and self-employed individuals who don’t have access to employer-sponsored insurance. Two popular options available are PPO (Preferred Provider Organization) plans and ACA (Affordable Care Act) marketplace plans. While both options provide healthcare coverage, they differ in structure, cost, network flexibility, and levels of coverage. Understanding these differences can help you make an informed choice based on your healthcare needs and budget. Here’s a closer look at each type and how they stack up for independent workers.

- What Is a PPO Plan?

A PPO, or Preferred Provider Organization plan, is a type of health insurance that offers flexibility in choosing healthcare providers. PPO plans typically have a wide network of doctors and hospitals, but they also provide the option to see out-of-network providers, usually at a higher out-of-pocket cost.

Key Features of PPO Plans:

- Flexibility: PPOs allow policyholders to see any healthcare provider without needing a referral from a primary care physician (PCP).

- Network and Out-of-Network Options: While costs are lower within the network, you can still access out-of-network providers if needed.

- Higher Premiums: PPO plans generally have higher premiums than HMO (Health Maintenance Organization) plans or ACA marketplace plans.

- Out-of-Pocket Costs: PPOs often come with deductibles, coinsurance, and copayments, particularly for out-of-network visits.

Pros of PPO Plans for Independent Workers:

- Freedom of Choice: Ideal for those who value provider flexibility and may need specialist care without referrals.

- Broad Network: PPOs often have extensive provider networks, especially in urban areas.

- Customizable Coverage: Independent workers can access diverse care options without limitations on their primary care physicians.

Cons of PPO Plans for Independent Workers:

- Higher Cost: Monthly premiums and out-of-pocket expenses are often higher, which may not be ideal for those on a tight budget.

- Complex Structure: Coinsurance, copays, and deductibles can make PPOs a bit complicated to manage.

2. What Is ACA Healthcare?

The ACA, or Affordable Care Act, was introduced to provide affordable healthcare coverage to Americans, regardless of employment status. Independent workers, freelancers, and other self-employed individuals can enroll in ACA marketplace plans, which include various coverage levels (bronze, silver, gold, platinum) depending on your healthcare needs and budget.

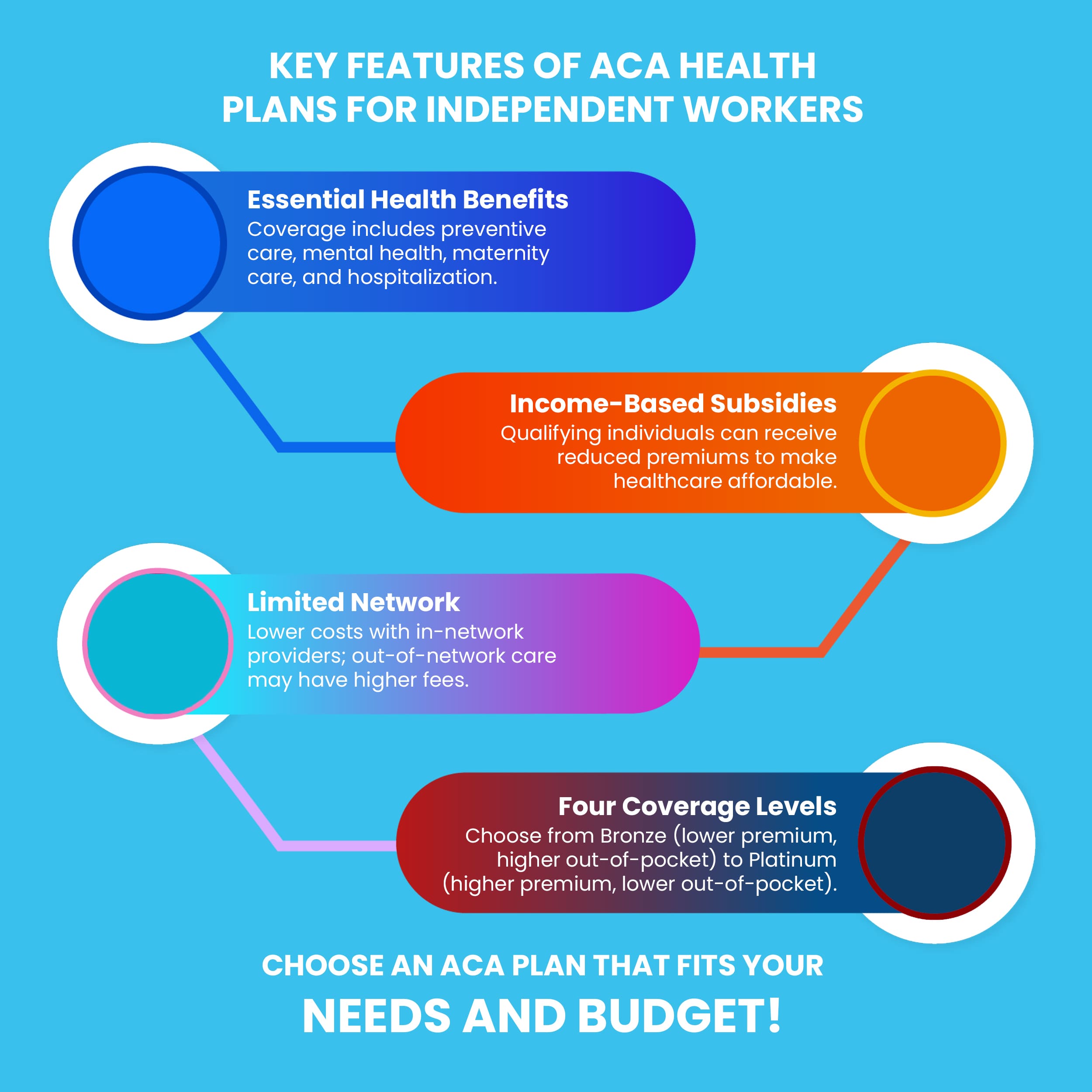

Key Features of ACA Plans:

- Essential Health Benefits: All ACA plans cover essential benefits, including preventive care, hospitalization, maternity care, mental health services, and more.

- Subsidies Based on Income: ACA plans offer income-based subsidies to make healthcare affordable. Independent workers who meet income requirements may qualify for reduced premiums.

- Limited Network: ACA plans, especially HMO-type plans on the marketplace, may have limited provider networks, meaning higher costs for out-of-network care.

- Four Coverage Levels: Bronze (lowest premium, highest out-of-pocket), Silver, Gold, and Platinum (highest premium, lowest out-of-pocket) allow independent workers to choose a plan based on anticipated healthcare needs and budget.

Pros of ACA Plans for Independent Workers:

- Affordability with Subsidies: Income-based subsidies make ACA plans affordable for many self-employed individuals.

- Comprehensive Coverage: ACA plans provide essential health benefits without exclusions for pre-existing conditions.

- Preventive Services: Preventive care is typically covered at no additional cost, allowing for affordable wellness check-ups.

Cons of ACA Plans for Independent Workers:

- Limited Networks: Some ACA plans have restricted networks, limiting provider options, especially for specialists or specific services.

- Variable Costs: Out-of-pocket costs can vary significantly based on the chosen plan level and type of care needed.

3. Comparing Cost Factors Between PPO and ACA Plans

For many independent workers, cost is a primary consideration when selecting a healthcare plan. Here’s a comparison of the cost factors associated with each:

Premiums and Deductibles:

- PPO Plans: Typically have higher monthly premiums but offer more extensive provider access. Deductibles can also be higher, especially for out-of-network care.

- ACA Plans: Premiums vary based on income and chosen coverage level. Bronze plans have lower premiums but higher deductibles, while Platinum plans have higher premiums but lower deductibles.

Out-of-Pocket Costs:

- PPO Plans: Out-of-pocket costs are higher for out-of-network services but generally lower within the network. PPOs often include copays and coinsurance.

- ACA Plans: Out-of-pocket costs are capped annually on ACA plans, providing protection against high healthcare expenses.

Subsidies and Tax Advantages:

- PPO Plans: Often don’t offer income-based subsidies unless provided through an employer-sponsored plan.

- ACA Plans: Independent workers with qualifying incomes can receive subsidies and tax credits to reduce premium costs, making ACA plans a more affordable option for many.

4. Network Flexibility and Provider Choice

When it comes to flexibility, PPO plans typically provide more freedom in choosing healthcare providers and accessing specialists, while ACA plans may restrict network access depending on the plan type.

- PPO Plans: Ideal for individuals who prioritize unrestricted access to specialists and out-of-network providers. PPO plans are well-suited for people with unique or ongoing healthcare needs who don’t want the limitation of referrals.

- ACA Plans: ACA plans often use HMO or EPO networks, meaning you may need referrals or face out-of-network costs. While these restrictions can lower costs, they may be less ideal for individuals needing specialized care.

5. Choosing the Right Plan Based on Healthcare Needs

The choice between a PPO and an ACA plan depends on personal healthcare needs, budget, and preferences for provider flexibility. Here’s how to decide:

- For Frequent Healthcare Users or Those with Specific Needs: A PPO plan’s flexibility and network options may be beneficial if you require frequent specialist care or prefer freedom in provider choice.

- For Budget-Conscious Independent Workers: ACA plans with income-based subsidies offer affordability and essential benefits, making them a solid choice for independent workers prioritizing cost-effective healthcare.

- For Those Prioritizing Preventive Care: Both PPO and ACA plans provide preventive care, but ACA plans often cover these services at no additional cost, which is beneficial for wellness-focused individuals.

Choosing between PPO and ACA healthcare plans depends on your priorities, whether it’s flexibility, cost savings, or comprehensive coverage. For independent workers and freelancers, ACA plans often provide an affordable solution with income-based subsidies and essential health benefits, making them accessible to a wide range of individuals. On the other hand, PPO plans offer greater provider flexibility and may be more suited to those with specific healthcare needs or preferences.

Ultimately, understanding the benefits, costs, and network options of each type can help you make an informed decision. Evaluating your healthcare needs and financial situation will guide you toward a plan that best supports your health and wellness goals. Whether you value network flexibility, preventive care, or low premiums, both PPO and ACA plans have unique advantages designed to meet the needs of independent workers in today’s evolving healthcare landscape.

Published on: Oct 25, 2024