How to Choose the Best Term Life Plan for Your Needs

When it comes to securing your family’s financial future, selecting the right term life plan is crucial. A term life plan provides coverage for a specified period, ensuring financial protection in the event of your untimely passing. It’s particularly beneficial for those needing substantial coverage at an affordable rate during key life stages, such as raising children or paying off a mortgage. With many options available, varying in term lengths and coverage amounts, choosing the right plan can be overwhelming. This guide will help you navigate the process, highlighting key factors, common pitfalls, and practical tips to make an informed decision, providing peace of mind and financial security for your family.

Understanding Term Life Plans

A term life plan is a type of life coverage that offers protection for a set period, typically ranging from 10 to 30 years. If the policyholder passes away during this term, the beneficiaries receive a death benefit. Unlike whole life coverage, term life plans do not build cash value, making them a more affordable option for many people. This lack of investment component also means that premiums are generally lower, allowing policyholders to allocate more funds toward other financial goals.

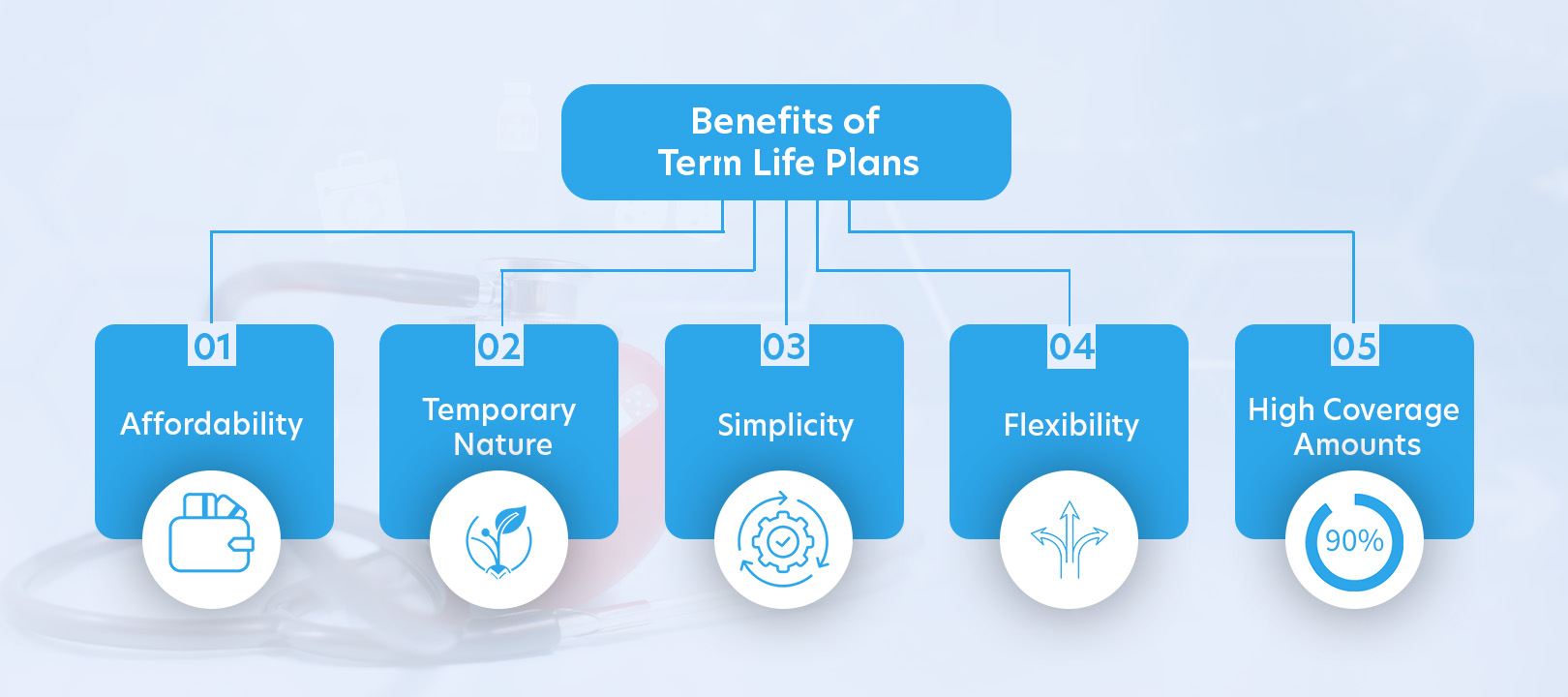

Benefits of Term Life Plans

Term life plans offer several benefits, including:

- Affordability: Term life plans are generally more affordable than permanent life coverage options, making them accessible for many families. The cost-effectiveness of these plans allows individuals to secure significant coverage without straining their budgets.

- Simplicity: These plans are straightforward, with no investment components or cash value accumulation. This simplicity makes them easy to understand and manage, without the complexities often associated with permanent life policies.

- Flexibility: Policyholders can choose the length of the term based on their specific needs and financial goals. Whether you need coverage for a short period or several decades, term life plans can be tailored to match your timeline.

- High Coverage Amounts: Term life plans typically offer higher coverage amounts at lower premiums compared to whole life plans. This higher coverage can provide substantial financial support to beneficiaries, ensuring their needs are met in the policyholder’s absence.

- Temporary Nature: The temporary nature of term life plans can be advantageous for those who need coverage only during specific periods, such as the duration of a mortgage or the years their children are dependent.

Factors to Consider When Choosing a Term Life Plan

When selecting a term life plan, it’s essential to consider several factors to ensure you choose the best policy for your needs.

1. Determine Your Coverage Needs

The first step in choosing the best term life plan is determining how much coverage you need. Consider the following:

- Financial Obligations: Calculate your outstanding debts, such as a mortgage, car loans, and credit card debt. Ensure the coverage amount is sufficient to pay off these debts, relieving your loved ones of this burden.

- Income Replacement: Determine how much income your family would need to maintain their current lifestyle. Consider your salary, additional income sources, and the duration your family would require financial support.

- Future Expenses: Consider future financial needs, such as college tuition for your children, wedding expenses, or retirement funds for your spouse. Including these considerations ensures comprehensive coverage that addresses various life stages.

- Final Expenses: Account for potential final expenses, including funeral costs, medical bills, and estate taxes. These costs can be significant, so it’s crucial to include them in your coverage calculation.

2. Choose the Right Term Length

The term length of your policy should align with your financial obligations and goals. Common term lengths include 10, 20, and 30 years. To determine the appropriate term length, consider:

- Mortgage Term: Choose a term that matches the remaining length of your mortgage. This approach ensures that your coverage lasts until your home is fully paid off.

- Children’s Ages: Select a term that covers the years until your children are financially independent. This coverage period should ideally last until they complete their education and start their careers.

- Retirement Goals: Ensure your term life plan covers the period until you and your spouse are retired and have sufficient savings. This consideration helps protect your spouse from financial hardship during retirement years.

- Career Stability: If you’re early in your career and expect your income to increase, consider a term length that covers the years until you reach peak earning potential. This strategy can help replace lost income in case of untimely death during your prime working years.

3. Compare Premium Costs

The cost of premiums is a crucial factor when choosing a term life plan. Compare quotes from multiple providers to find the best rate for the coverage amount and term length you need. Keep in mind that premiums are influenced by several factors, including:

- Age: Younger policyholders typically receive lower premium rates. Locking in a policy at a younger age can result in significant savings over the policy’s term.

- Health: Non-smokers and those in good health generally qualify for lower premiums. Insurance providers may require a medical exam to assess your health status.

- Lifestyle: Risky hobbies or occupations can increase premium costs. Be transparent about these factors, as withholding information can lead to complications in the future.

- Policy Features: The inclusion of riders or additional benefits can affect premium costs. Evaluate whether these added features are necessary for your specific needs.

4. Evaluate the Coverage Provider

Choosing a reputable coverage provider is just as important as selecting the right term life plan. Consider the following when evaluating providers:

- Financial Strength: Research the financial stability of the company to ensure they can meet their future obligations. Ratings from agencies like A.M. Best, Moody’s, and Standard & Poor’s can provide insight into the company’s financial health.

- Customer Service: Look for providers with positive customer reviews and a strong reputation for customer service. Reliable customer support is essential, especially during the claims process.

- Claims Process: Investigate the claims process to ensure it is straightforward and efficient. A smooth claims process can significantly reduce stress during challenging times.

- Company History: Consider the provider’s history and experience in the industry. Companies with a long track record are often more reliable and stable.

5. Understand Policy Features and Riders

Term life plans often come with additional features and options known as riders. These can enhance your coverage and provide added flexibility. Common riders include:

- Waiver of Premium: This rider waives your premium payments if you become disabled and are unable to work. It ensures your coverage continues even if you can’t afford the premiums due to disability.

- Accelerated Death Benefit: Allows you to access a portion of your death benefit if you are diagnosed with a terminal illness. This feature can provide financial relief during a critical time.

- Conversion Option: Provides the option to convert your term life plan to a permanent life coverage policy without a medical exam. This flexibility can be beneficial if your needs change over time.

- Accidental Death Benefit: This rider provides an additional death benefit if the policyholder dies due to an accident. It can offer extra protection for those with high-risk occupations or hobbies.

6. Read the Fine Print

Before finalizing your term life plan, carefully read the policy documents to understand all terms and conditions. Pay attention to:

- Exclusions: Be aware of any exclusions or limitations in the policy. Understanding these details helps avoid surprises during the claims process.

- Renewability: Check if the policy is renewable and under what conditions. Some policies may allow renewal at a higher premium without a medical exam.

- Grace Period: Understand the grace period for missed payments. Knowing this period can prevent policy lapses due to unintentional missed payments.

Tips for Securing the Best Term Life Plan

- Start Early: The earlier you purchase a term life plan, the lower your premiums will be. Young, healthy individuals are considered lower risk, resulting in more affordable coverage.

- Shop Around: Don’t settle for the first quote you receive. Shop around and compare multiple policies to find the best coverage at the best price.

- Be Honest on Your Application: Provide accurate information on your application to avoid issues with your policy later on. Misrepresentation can result in denied claims or policy cancellation.

- Reevaluate Your Needs Periodically: Life circumstances change, and so do your coverage needs. Reevaluate your term life plan periodically to ensure it still meets your financial goals and obligations.

- Consult a Financial Advisor: A financial advisor can provide personalized guidance on choosing the best term life plan. They can help you assess your financial situation, determine appropriate coverage amounts, and select the right term length and riders.

Choosing the best term life plan requires careful consideration of your financial obligations, term length, premium costs, and the provider’s reputation. Start by evaluating your current financial situation, including debts and future responsibilities. Consider how long you need coverage, such as until your children are grown or your mortgage is paid off. Compare premium costs across providers to ensure affordability. Research the financial stability and customer service of providers. Regularly revisit your plan to adjust coverage as your financial situation changes. This proactive approach ensures your plan meets your needs over time, providing ongoing security and peace of mind for your family.

Publish on: Aug 1, 2024