Health Savings Accounts vs. Flexible Spending Accounts

Choosing the right health plan is crucial for small business owners and freelancers. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are two popular options that can help you save money on medical expenses. Understanding the differences between these accounts can help you make an informed decision that best suits your needs. This guide will cover the basics of HSAs and FSAs, highlight their benefits, and provide tips on choosing the right one for your situation. By the end, you’ll have a clearer understanding of which account aligns with your financial and healthcare needs.

What is a Health Savings Account (HSA)?

Definition and Purpose: A Health Savings Account (HSA) is a tax-advantaged savings account designed to help individuals save for qualified medical expenses. Contributions are made on a pre-tax basis, reducing your taxable income, and the funds can be used to pay for a wide range of healthcare costs, including deductibles, copayments, and some other expenses not covered by insurance.

Eligibility Requirements: To qualify for an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). HDHPs feature higher deductibles and lower premiums compared to traditional health plans, making them more affordable but requiring you to cover more of your initial healthcare costs out-of-pocket.

Contribution Limits: For 2024, you can contribute up to $3,850 for individual coverage and $7,750 for family coverage. If you’re 55 or older, you can make an additional “catch-up” contribution of $1,000, bringing the total maximum contribution to $4,850 for individuals and $8,750 for families.

Key Features and Benefits

- Tax Advantages: Contributions to your HSA are tax-deductible, reducing your taxable income. Withdrawals used for qualified medical expenses are tax-free, and the account’s earnings grow tax-deferred.

- Portability: The money in your HSA belongs to you and remains with you even if you change jobs or retire. This makes it a long-term savings tool.

- Investment Options: Many HSAs offer investment options, allowing you to invest the funds in stocks, bonds, or mutual funds, potentially increasing your savings over time.

What is a Flexible Spending Account (FSA)?

Definition and Purpose: A Flexible Spending Account (FSA) is an employer-established benefit that allows you to set aside pre-tax money for out-of-pocket health care costs. This can include expenses like medical co-pays, prescription medications, and some over-the-counter items.

Eligibility Requirements: FSAs are available only through an employer’s benefits program. Self-employed individuals are not eligible for FSAs unless they are also receiving W-2 income from another employer that offers this benefit.

Contribution Limits: For 2024, you can contribute up to $3,050 annually to an FSA. This limit is set by the IRS and may adjust in future years based on inflation and other factors.

Key Features and Benefits

- Tax Advantages: Contributions reduce your taxable income, which can lead to tax savings. The funds in the account are used on a pre-tax basis, further reducing your out-of-pocket expenses.

- Immediate Access: Unlike HSAs, you have access to the full annual contribution amount from the start of the plan year, which can be useful for planned or unexpected medical expenses.

- Dependent Care FSAs: Some FSAs also offer a dependent care option, which allows you to use the funds for childcare or other dependent care expenses.

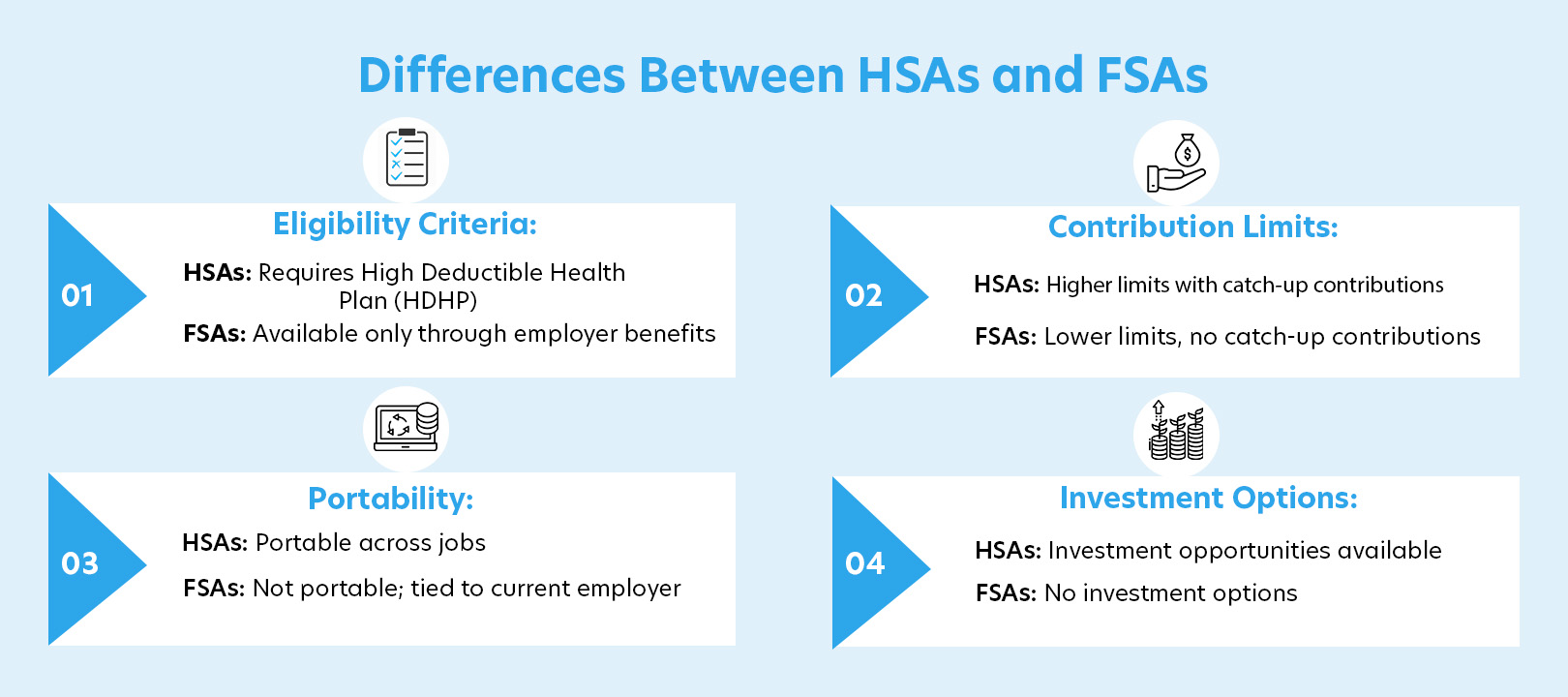

Key Differences Between HSAs and FSAs

Eligibility Criteria

- HSAs:Requires enrollment in a High Deductible Health Plan (HDHP).

- FSAs: Available through employer benefits programs, regardless of your health plan type.

Contribution Limits

- HSAs: Higher contribution limits compared to FSAs and allow catch-up contributions for those aged 55 and older.

- FSAs: Lower contribution limits and no catch-up contributions.

Use-It-or-Lose-It Rule

- HSAs: Funds roll over year after year with no expiration, allowing for long-term savings growth.

- FSAs: Subject to the “use-it-or-lose-it” rule, meaning you must spend the money within the plan year or forfeit it. Some plans offer a grace period or allow a limited carryover of funds.

Portability

- HSAs: Portable; you keep the account and its funds even if you switch jobs or retire.

- FSAs:Not portable; the account is tied to your employer, and you lose it if you change jobs or if the employer discontinues the plan.

Investment Options

- HSAs: Often offer investment opportunities to grow your savings.

- FSAs: Funds are not eligible for investment and must be used for qualified expenses.

Advantages and Disadvantages of HSAs

Advantages:

- Long-Term Savings Potential: Unused funds roll over each year and can be invested, potentially building a substantial healthcare nest egg.

- Tax Benefits: Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Flexibility: Use funds for a broad range of medical expenses, including dental and vision care.

Disadvantages:

- HDHP Requirement: Must be enrolled in a high-deductible health plan, which may have higher out-of-pocket costs.

- Potential High Out-of-Pocket Costs: HDHPs may lead to higher initial medical expenses before the deductible is met.

Advantages and Disadvantages of FSAs

Advantages:

- No Specific Health Plan Required: Available with any employer-provided health plan, providing flexibility in health plan choice.

- Immediate Access to Funds: Full contribution amount is available at the beginning of the plan year, aiding in managing anticipated medical expenses.

- Covers a Wide Range of Expenses: Includes medical, dental, vision, and sometimes dependent care expenses.

Disadvantages:

- Use-It-or-Lose-It Rule: Unused funds may be forfeited at the end of the plan year, though some plans offer a grace period or limited carryover.

- Lack of Portability: Tied to your current employer; if you leave or change jobs, you lose the account.

- No Investment Options: Funds cannot be invested for growth.

How to Choose Between an HSA and FSA

Assess Your Healthcare Needs

Consider your typical healthcare expenses. If you have high ongoing medical costs, an HSA might be more beneficial due to its higher contribution limits and rollover feature.

Evaluate Your Financial Situation

HSAs are better for those who can afford the higher deductibles associated with HDHPs. FSAs might be more suitable if you prefer lower deductibles and immediate access to funds.

Consider Your Employment Status

If you’re self-employed or your employer doesn’t offer an FSA, an HSA is your only option. For those employed by a company that offers FSAs, this might be the easier choice.

Understand Employer Contributions

Check if your employer contributes to either an HSA or FSA. Employer contributions can significantly increase your savings.

Choosing between an HSA and an FSA depends on your personal and financial situation. Both accounts offer valuable tax advantages and can help you save on healthcare costs. Understanding the differences and benefits of each can help you make the best choice for your needs. Whether you opt for an HSA or an FSA, both are excellent tools for managing your healthcare expenses and ensuring financial stability. By considering your healthcare needs, financial situation, and employment status, you can decide which account best suits your needs. Remember, making an informed decision will not only help you save money but also provide peace of mind when it comes to managing your healthcare expenses.

Publish on: Aug 5, 2024