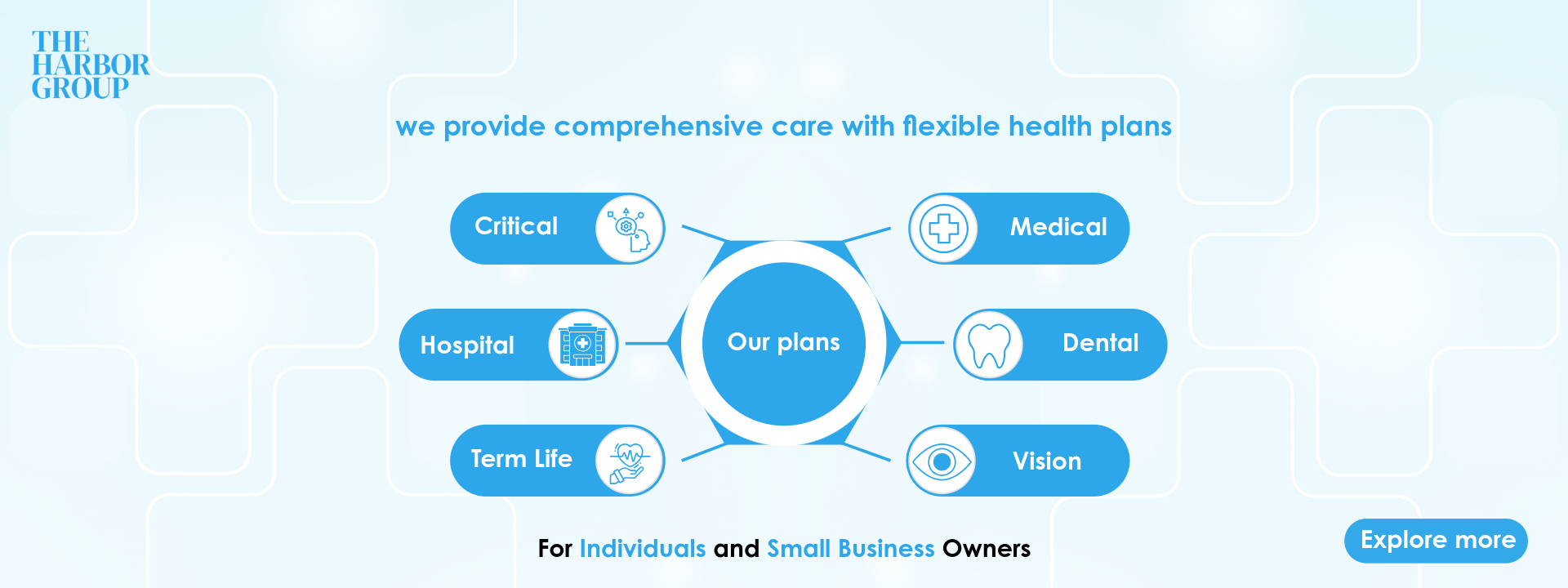

Critical Illness Coverage An Essential Part of Your Health Plan

In the fast-evolving world of healthcare, the risk of critical illnesses like cancer, heart disease, and stroke is ever-present. These life-altering conditions not only threaten our well-being but also place an enormous financial strain on individuals and their families. Despite advancements in medical technology leading to higher survival rates, the costs associated with treatment, loss of income, and the potential need for long-term care can rapidly drain savings, pushing families into financial hardship. This is where critical illness coverage steps in as a crucial element of your health plan. Acting as a financial lifeline, it shields you from the economic toll of serious health issues, allowing you to focus on what truly matters—your recovery—without the overwhelming worry of financial stress. In this blog, we’ll explore why critical illness coverage is an essential part of any health plan, particularly when considering national PPO options, and how it can provide you with peace of mind in uncertain times.

What is Critical Illness Coverage?

Critical illness coverage is a type of plan that provides a lump-sum payment if you are diagnosed with a serious illness covered by the policy. Unlike regular health plans, which typically reimburse medical expenses, critical illness coverage gives you a cash benefit that can be used at your discretion. This money can cover a range of costs, including out-of-pocket medical expenses, lost income, rehabilitation, and even daily living expenses like mortgage payments or childcare. The flexibility of this coverage makes it a vital part of any health plan.

Why Critical Illness Coverage is Essential

The financial burden of a critical illness can be overwhelming, even with a solid health plan. Traditional health plans may cover hospital stays and medical treatments, but they often don’t address other costs, such as loss of income during recovery or non-medical expenses like home modifications or specialized care. Critical illness coverage fills this gap, providing the financial support needed to focus on recovery without the added stress of financial worries. With healthcare costs continuing to rise, having this coverage ensures that you are prepared for the unexpected.

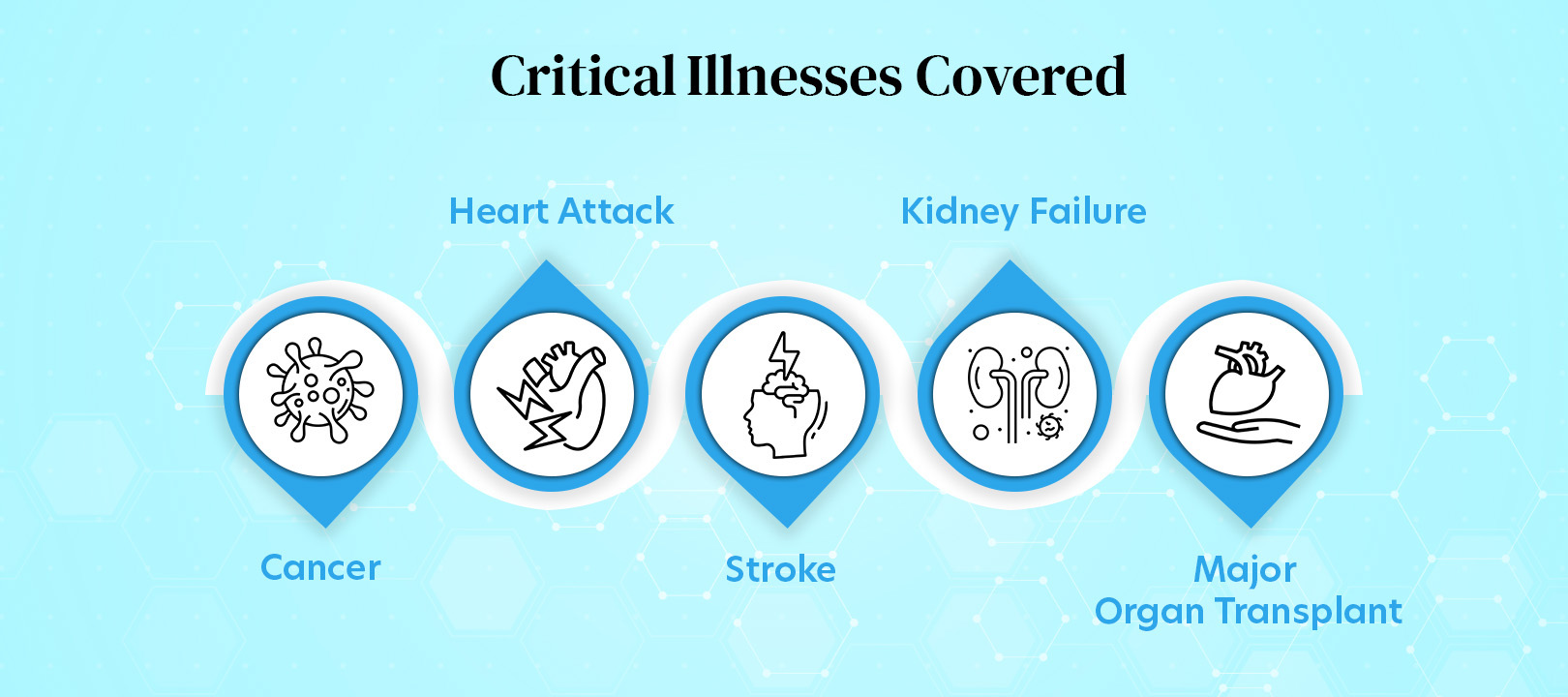

Common Illnesses Covered

Most critical illness plans offer coverage for a broad spectrum of serious health conditions, providing financial support when you need it most. While the exact list of covered illnesses can vary by provider, some conditions are almost universally included due to their prevalence and impact on individuals’ lives. Below are some of the most commonly covered illnesses:

- Cancer: Cancer remains one of the leading causes of death globally, affecting millions each year. The cost of cancer treatment, including surgery, chemotherapy, radiation therapy, and long-term care, can be staggering. Critical illness coverage provides a lump-sum payment that can help manage these expenses, allowing patients to focus on recovery without the stress of financial worries. This coverage is particularly vital as it can also support non-medical costs, such as travel to specialized treatment centers or modifications to the home environment to accommodate the patient’s needs.

- Heart Attack: Heart attacks, or myocardial infarctions, are another leading cause of death worldwide. Recovery from a heart attack often necessitates significant time off work, along with expensive medical care, including surgery, medication, and lifestyle changes. The financial burden can be overwhelming, especially if the patient is the primary earner in the household. Critical illness coverage provides a lump-sum payment that can ease this financial burden, ensuring that the individual and their family are supported during the recovery process.

- Stroke: Strokes can have a devastating impact, often leading to long-term disability that requires extensive rehabilitation and ongoing medical care. This can include physical therapy, occupational therapy, speech therapy, and possibly permanent modifications to the home. The costs associated with stroke recovery can be significant, and traditional health plans may not cover all expenses. Critical illness coverage offers the financial flexibility to manage these costs, providing funds that can be used for therapy, lifestyle adjustments, or even hiring in-home care.

- Kidney Failure: Kidney failure often necessitates ongoing dialysis treatment or a kidney transplant, both of which are financially draining. Dialysis, in particular, can be a lifelong necessity, requiring frequent hospital visits and specialized care. A kidney transplant, while potentially curative, involves significant costs related to surgery, post-operative care, and immunosuppressive medications. Critical illness coverage helps cover these substantial costs, ensuring that patients have the financial support they need throughout their treatment journey.

- Major Organ Transplant: Organ transplants, such as liver, lung, or heart transplants, are among the most expensive medical procedures. The surgery itself, coupled with post-operative care, rehabilitation, and the cost of lifelong immunosuppressive medications, can lead to financial strain. Even with traditional health plans, out-of-pocket costs can be significant. Critical illness coverage can help manage these expenses, offering a lump-sum payment that provides the necessary financial cushion to cover medical and non-medical costs during the recovery period.

How to Choose the Right Critical Illness Coverage

- Plan Terms and Conditions: Before committing to a plan, it’s essential to provider with a strong reputation for paying out claims promptly and fairly will give yoSelecting the right critical illness coverage requires careful consideration of several key factors to ensure that the plan meets your specific needs. Here are some important aspects to consider:

- Coverage Amount: Determining the appropriate coverage amount is crucial. Start by assessing your financial needs, including potential income replacement, medical expenses, and out-of-pocket costs that might arise during the treatment and recovery process. The coverage amount should be sufficient to maintain your standard of living, pay off any debts, and cover other financial obligations. It’s important to strike a balance between adequate coverage and affordability.

- Covered Conditions: Not all critical illness plans are created equal. It’s essential to review the list of illnesses covered by the plan to ensure it includes conditions that are relevant to your health history or risk factors. For example, if you have a family history of heart disease, ensuring that heart attack and stroke are covered is paramount. Some plans may also offer riders or add-ons that allow you to customize the coverage to include additional conditions.

- Waiting Period: Most critical illness plans include a waiting period, which is the time you must wait after the plan start date before you can claim the benefits. This period can vary significantly between providers, typically ranging from 30 to 90 days. Understanding the waiting period is crucial, as a longer waiting period could delay access to the financial support you might need. Ensure that the waiting period aligns with your risk tolerance and health condition.

- Premiums: Premium costs are a vital consideration when choosing critical illness coverage. While it’s important to secure a plan that provides adequate protection, the premiums should also fit within your budget. Comparing different plans and their premiums can help you find a plan that offers the best value for money. Remember that premiums can be influenced by factors such as your age, health status, and the extent of coverage. Some plans may offer level premiums, which remain the same throughout the term, while others may have increasing premiums over time.

- thoroughly review the terms and conditions. Pay close attention to any exclusions, such as pre-existing conditions, and understand the claims process. Some plans may require proof of the diagnosis from specific medical professionals or institutions. Understanding these details will ensure that you can access the benefits when needed without unexpected hurdles.

- Provider Reputation and Claims Process: The reputation of the provider and the efficiency of their claims process should also factor into your decision. Research the provider’s track record for handling claims, customer service, and overall reliability. Choosing au added peace of mind.

- Flexibility and Future Needs: As your life circumstances change, so too might your coverage needs. Look for a plan that offers flexibility, such as the ability to increase coverage or add riders as your situation evolves. Some providers may also offer the option to renew your plan or convert it to another type of coverage as you age.

The Critical Role of Critical Illness Coverage in Your Financial Strategy

Critical illness coverage goes beyond just safeguarding your health—it’s a vital component of a sound financial strategy. In the event of a serious illness, the lump-sum payment provided by this coverage can help you maintain your lifestyle, meet ongoing expenses, and secure your family’s financial future, even during the most challenging times. For individuals with dependents or significant financial commitments like a mortgage or education costs, critical illness coverage offers invaluable peace of mind, acting as a safety net against potential financial turmoil.

More than just an add-on to your health plan, critical illness coverage is an essential layer of protection for you and your loved ones. It empowers you with the financial flexibility needed to navigate the hurdles that come with a serious diagnosis, allowing you to focus on recovery without the added burden of economic stress. As healthcare costs continue to escalate, integrating critical illness coverage into your comprehensive health plan is not just a wise choice—it’s a necessary one. Take the time to assess your risk factors, evaluate your current health plan, and discover how critical illness coverage can safeguard your financial future in an unpredictable world.

Published on: Aug 15, 2024