Balancing Cost and Coverage Finding the Right Health Plan

Choosing the right health plan is essential for financial stability and overall well-being. With numerous options offering varying coverage levels and costs, finding the right balance can be challenging. You may need to decide between higher premiums with lower out-of-pocket expenses or lower premiums with potentially high deductibles. We’ll guide you through balancing cost and coverage, helping you make an informed choice that suits your healthcare needs while effectively managing expenses. By thoroughly understanding your options and personal needs, you can achieve peace of mind with the perfect plan that fits your lifestyle in place.

Understanding Health Plan Options

Health plans come in various types, each with its own features and benefits:

- Health Maintenance Organization (HMO): Requires you to choose a primary care physician (PCP) and get referrals for specialists. Typically has lower premiums and out-of-pocket costs but less flexibility in choosing healthcare providers. This type is ideal for individuals who prefer lower costs and don’t mind having a designated PCP.

- Preferred Provider Organization (PPO): Offers more flexibility in choosing healthcare providers and does not require referrals. Generally has higher premiums and out-of-pocket costs. PPO plans are suitable for those who value having more control over their healthcare choices and don’t mind paying a bit more for the flexibility.

- Exclusive Provider Organization (EPO): Similar to PPOs but does not cover any out-of-network care except in emergencies. Lower premiums than PPOs but less flexibility. EPO plans are best for those who prefer lower premiums and are comfortable with a more restricted network.

- High Deductible Health Plan (HDHP): Features lower premiums and higher deductibles. Often paired with Health Savings Accounts (HSAs) to help save on taxes and cover out-of-pocket expenses. HDHPs are ideal for those who are generally healthy, want to save on premiums, and are willing to manage higher out-of-pocket costs.

Key Terms to Know:

- Premiums: The monthly cost you pay for your health coverage, regardless of whether you use medical services.

- Deductibles: The amount you pay out-of-pocket before your coverage starts to cover expenses. Higher deductibles often mean lower premiums.

- Co-pays: Fixed amounts you pay for specific services or prescriptions, typically required at the time of service.

- Out-of-Pocket Maximum: The most you’ll pay for covered services in a year, including deductibles, co-pays, and co-insurance. Once this limit is reached, the coverage covers 100% of additional costs.

Understanding these options and related terms can help you make a more informed decision and select a plan that aligns with your financial situation and healthcare needs.

Evaluating Your Healthcare Needs

To select the best plan, start by assessing your healthcare needs:

- Current and Future Medical Needs: Consider any ongoing treatments, medications, or frequent medical visits. If you anticipate major health changes, such as starting a family, account for these in your plan selection. Evaluate the likelihood of needing specialist care or complex treatments.

- Family or Dependent Needs: If you’re selecting a plan for a family, evaluate the needs of each member, including children’s care and any special medical requirements. Factor in potential future needs, such as orthodontics for children or maternity care.

- Preventive Care: Ensure the plan covers preventive services, such as vaccinations and screenings, which are crucial for maintaining long-term health. Look for plans that offer comprehensive coverage for routine check-ups and wellness visits.

Assessing Health Risk Factors:

- Chronic Conditions: If you have a chronic condition, such as diabetes or heart disease, ensure the plan provides adequate coverage for ongoing treatments, specialist visits, and prescription medications.

- Lifestyle Factors: Consider lifestyle factors that may impact your health, such as smoking or high-stress jobs, which may require additional coverage or preventive services. Evaluate the support provided for managing lifestyle-related health risks.

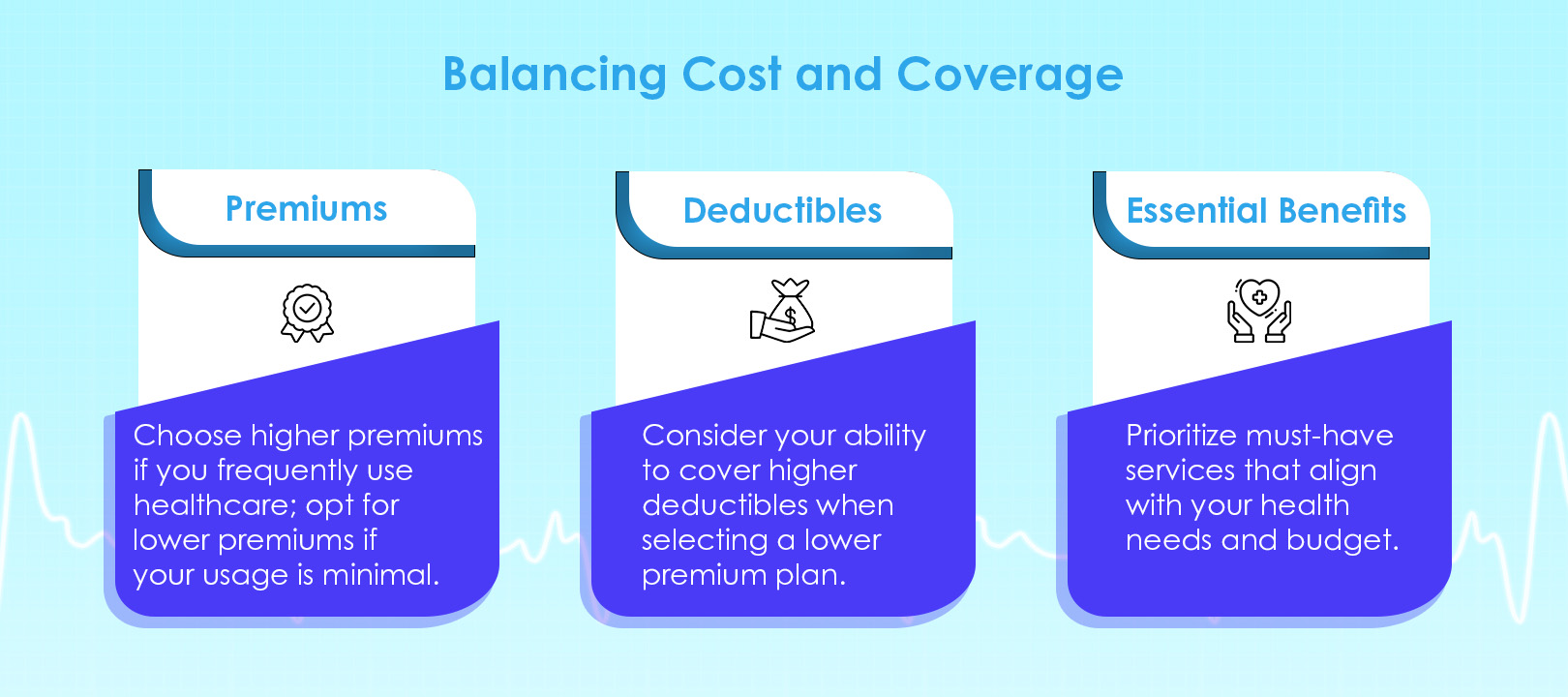

Balancing Cost and Coverage

Finding the right balance involves comparing costs and benefits:

- Premiums vs. Out-of-Pocket Expenses: Higher premium plans often have lower out-of-pocket costs, but if you rarely use healthcare services, a plan with lower premiums and higher out-of-pocket costs might be more economical. Calculate potential annual costs based on your expected healthcare usage.

- Deductibles and Coverage Trade-Offs: Lower premium plans usually come with higher deductibles. Consider how often you anticipate using healthcare services and whether you can afford the deductible if unexpected medical costs arise. Balance the potential savings on premiums against the risk of higher out-of-pocket expenses.

- Must-Have vs. Optional Benefits: Identify essential services you need, such as emergency care or chronic disease management, and compare these with additional benefits that might be nice to have but not crucial. Prioritize coverage that aligns with your health needs and financial situation.

Analyzing Network Coverage:

- In-Network vs. Out-of-Network: Understand which healthcare providers are included in your plan’s network and how out-of-network services are covered, as this can significantly impact your overall costs. Check if your preferred doctors and hospitals are in-network and consider the implications of out-of-network care.

Maximizing Benefits While Minimizing Costs

To make the most of your plan:

- Utilize Employer-Sponsored Plans: Many employers offer health plans with negotiated rates and additional benefits. Take advantage of these offerings if available. Explore the full range of benefits provided by your employer’s plan, including wellness programs and telemedicine services.

- Explore Government Subsidies: Depending on your income, you might qualify for government subsidies or tax credits that can lower your coverage costs. Research eligibility for programs such as the Affordable Care Act (ACA) subsidies or Medicaid.

- Negotiate Coverage Rates: If you’re purchasing coverage independently, shop around and compare rates from different providers to find the best deal. Consider using comparison tools and seeking advice from coverage brokers to find the most cost-effective options.

Leveraging Additional Resources:

- Health Savings Accounts (HSAs): If you have an HDHP, use HSAs to save money tax-free for medical expenses. Contribute regularly to maximize tax benefits and cover out-of-pocket costs.

- Flexible Spending Accounts (FSAs): Utilize FSAs to cover out-of-pocket costs with pre-tax dollars. Understand the rules around FSA contributions and use-it-or-lose-it provisions.

Making an Informed Decision

Before finalizing your decision:

- Research and Compare: Use online tools and resources to compare different plans based on coverage, costs, and provider networks. Review plan details carefully to understand what’s covered and what’s not.

- Seek Expert Advice: Consult with health coverage brokers or advisors who can offer personalized guidance and help you understand complex plan details. Leverage their expertise to navigate options and make an informed choice.

- Understand Enrollment: Be aware of enrollment periods and deadlines to avoid missing out on your preferred plan. Keep track of open enrollment periods and any special enrollment opportunities.

Regular Review and Adjustment:

- Annual Reviews: Review your health plan annually to ensure it continues to meet your needs and to explore any new options or changes in coverage. Update your plan based on any significant life changes or health updates.

- Plan Adjustments: Make adjustments as necessary based on changes in your health status or life circumstances. Reevaluate your plan if you experience major health events or changes in your family’s needs.

Choosing the right health plan is more than just a financial decision—it’s about securing the best possible care for yourself and your family while managing costs effectively. By thoroughly understanding the types of health plans, evaluating your healthcare needs, and strategically balancing cost with coverage, you can make a choice that aligns with your priorities and financial situation. Remember to regularly review your health plan to ensure it continues to meet your needs as they change over time. With careful planning and informed decision-making, you can achieve the right balance, ensuring both your health and financial well-being are well protected. This proactive approach will help you stay prepared for both expected and unexpected healthcare needs, making sure you have the coverage you need without undue financial strain.

Publish on: Aug 12, 2024