Affordable Healthcare Solutions for Small Businesses and Freelancers

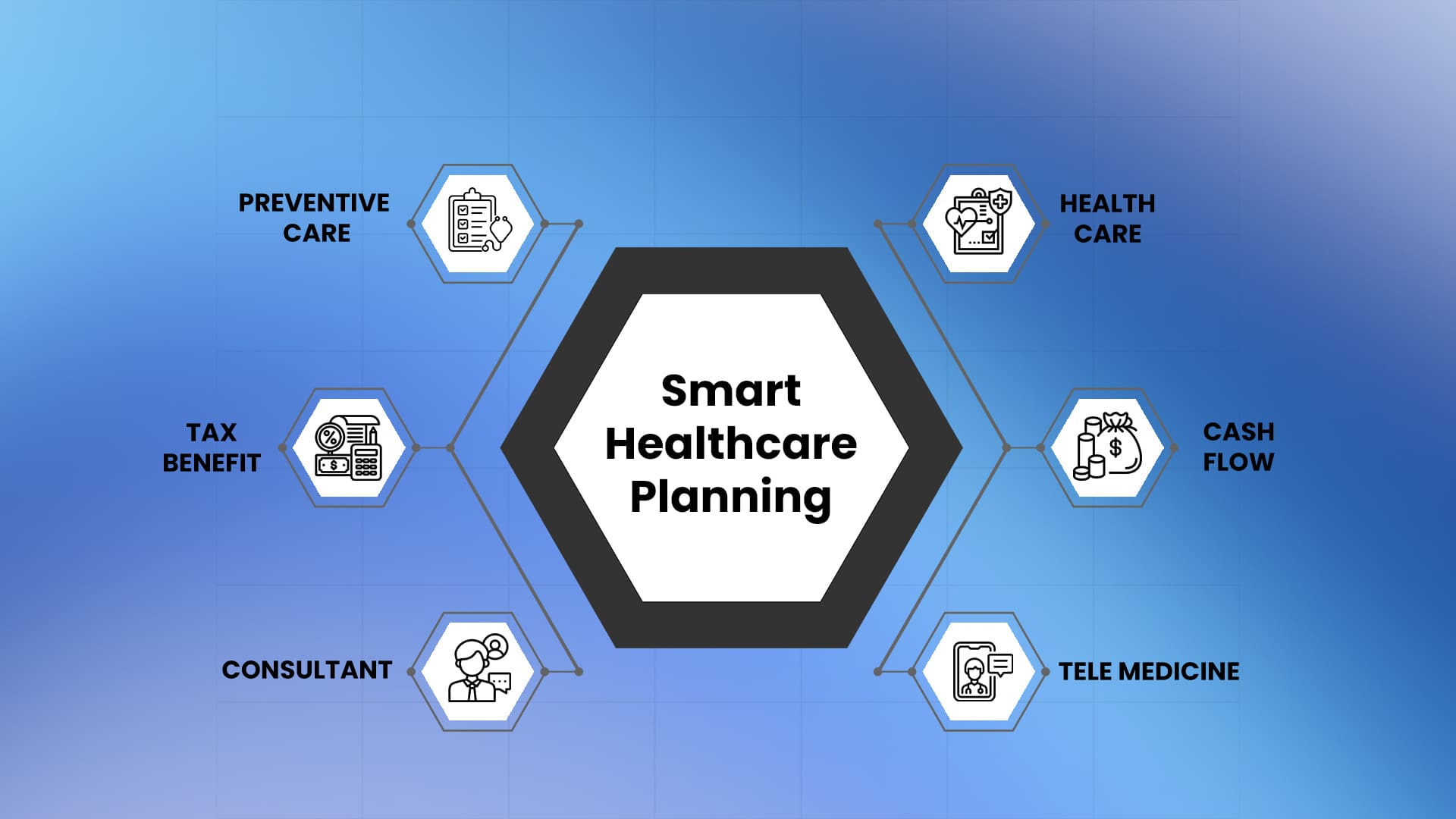

Finding affordable healthcare solutions is a significant challenge for small businesses and freelancers alike. With the rising costs of medical care and the complexities of choosing the right health plan, many small business owners and independent workers need help finding comprehensive coverage that fits their budgets. As a result, healthcare can often become a major expense or, worse, an overlooked necessity. However, having access to quality health plans is crucial for ensuring the well-being and productivity of your team or yourself if you’re self-employed. We understand these challenges at Harbor Group and are committed to helping small businesses and freelancers find cost-effective healthcare solutions. In this guide, we’ll explore practical options to help you access affordable yet comprehensive coverage, ensuring you don’t compromise on quality care.

1. Understanding Your Healthcare Needs

The first step in finding affordable healthcare solutions is to assess your specific needs. For small businesses, this means understanding what type of coverage your employees value most. Freelancers and independent workers should evaluate their healthcare requirements based on factors like medical history, lifestyle, and potential risks.

Tips:

- Survey to identify the most important healthcare features for your employees.

- Consider how often you visit doctors, need prescription medications, or require specialist care.

- List essential benefits such as preventive care, mental health support, or maternity coverage.

By clearly identifying your needs, you can focus on finding a plan that covers what matters most without paying for unnecessary extras.

2. Explore PPO Networks for Flexibility

PPO (Preferred Provider Organization) networks are popular among small businesses and freelancers because of their flexibility. PPO plans allow you to choose from a wide range of healthcare providers, and you don’t need a referral to see a specialist. This flexibility makes PPO networks ideal for those who want more control over their healthcare choices.

Benefits of PPO Plans:

- Access to a large network of healthcare providers.

- Freedom to see specialists without a referral.

- Coverage for both in-network and out-of-network providers.

Harbor Group offers a variety of PPO network options that cater to the needs of small businesses and freelancers, ensuring you have the flexibility to choose the right providers without compromising affordability.

3. Consider High-Deductible Health Plans with HSAs

High-Deductible Health Plans (HDHPs) paired with a Health Savings Account (HSA) can be an excellent way to save on healthcare costs. HDHPs typically have lower monthly premiums, making them an affordable option for small businesses and freelancers. An HSA allows you to set aside pre-tax money to cover medical expenses, making it easier to manage out-of-pocket costs.

Why Choose an HDHP with HSA?

- Lower monthly premiums mean reduced overall costs.

- HSAs offer tax advantages, helping you save more money.

- Unused HSA funds roll over each year, allowing you to build savings for future healthcare needs.

Harbor Group offers HDHPs with HSA options that provide comprehensive coverage while helping you maintain control over your healthcare expenses.

4. Leverage Telemedicine Services

Telemedicine is a game-changer for affordable healthcare, especially for freelancers and small businesses. It allows you to consult with healthcare professionals via phone or video calls, eliminating the need for in-person visits. Telemedicine services are often more affordable than traditional doctor visits and offer convenience for busy professionals.

Advantages of Telemedicine:

- Lower costs for consultations and follow-up visits.

- Access to healthcare professionals 24/7.

- Reduced time spent traveling or waiting for appointments.

Incorporating telemedicine into your healthcare plan can significantly reduce expenses while providing immediate access to care when needed.

5. Utilize Group Health Plans for Small Businesses

For small businesses, group health plans can offer more affordable rates compared to individual plans. By pooling together a group of employees, you can negotiate better rates and access more comprehensive coverage. Harbor Group specializes in helping small businesses find group health plans that balance cost and quality, ensuring your employees receive the care they deserve.

Benefits of Group Health Plans:

- Lower per-person costs due to shared risk among participants.

- Comprehensive coverage options tailored to your team’s needs.

- Ability to offer employees a valuable benefit that can improve retention and satisfaction.

6. Compare ACA Health Plans and Subsidies

The Affordable Care Act (ACA) marketplace offers a variety of health coverage options tailored for freelancers and small businesses. Depending on your income level, you may qualify for subsidies that make these plans more budget-friendly. Comparing different ACA plans can help you identify coverage that suits your needs and financial situation.

Tips for Finding Affordable ACA Plans:

- Use the income estimator on the ACA marketplace to determine your eligibility for subsidies.

- Compare different plan levels (Bronze, Silver, Gold, and Platinum) to find the best balance of premiums and coverage.

- Explore small business health options through the Small Business Health Options Program (SHOP).

Harbor Group can guide you through selecting an ACA plan, ensuring you find a solution that combines affordability with comprehensive coverage.

7. Explore Health Sharing Programs

Health-sharing programs offer an alternative approach, where members pool funds to cover each other’s medical expenses. These programs can be a cost-effective option for freelancers who are generally healthy and looking for an affordable way to manage healthcare needs.

Advantages of Health Sharing Programs:

- Lower monthly contributions compared to traditional health coverage.

- Flexibility in choosing healthcare providers.

- A community-based approach to managing healthcare expenses.

While health-sharing programs differ from conventional health plans, they can be a viable option for freelancers seeking budget-friendly healthcare solutions.

Finding affordable healthcare solutions for small businesses and freelancers doesn’t have to be complicated. By understanding your healthcare needs, exploring flexible options like PPO networks, leveraging telemedicine, and considering cost-saving strategies such as HDHPs with HSAs, you can access quality coverage without exceeding your budget.

At Harbor Group, we specialize in helping small businesses and freelancers find the right health plans that fit their needs and budget. Whether you’re looking for comprehensive group plans, individual options, or guidance on navigating the ACA marketplace, we’re here to support you.

Ready to discover how Harbor Group can provide affordable healthcare solutions tailored to your needs? Visit Harbor Group Health Plans and take the first step toward ensuring you and your employees have access to the quality care you deserve.

Published on: March 20, 2025