13 Things About Health Plans You May Not Have Known

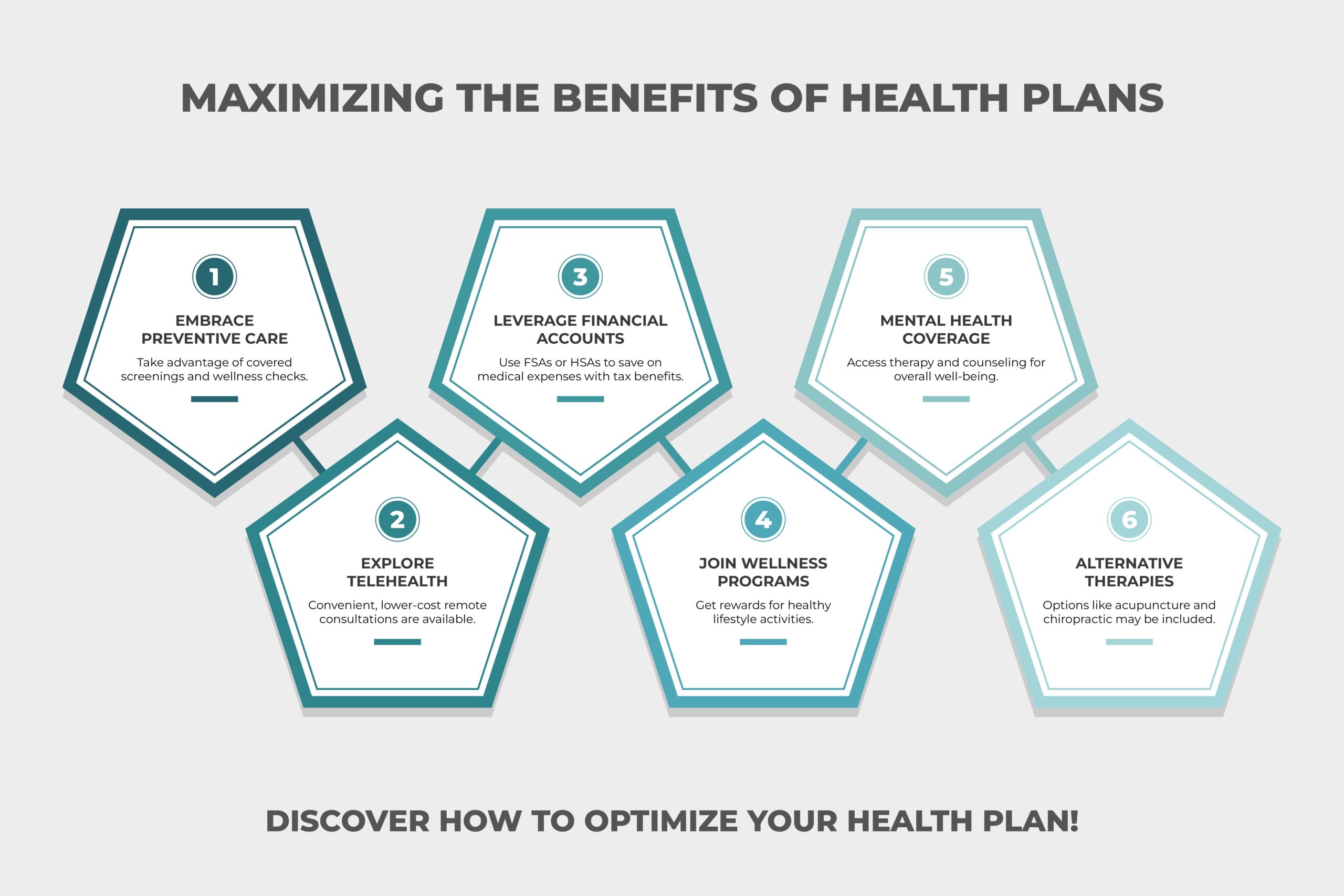

Health plans offer a lot more than just basic medical coverage. They often come with additional benefits, features, and opportunities that many people may not be aware of. In this blog, we’ll dive into some lesser-known facts about health plans that could help you make better choices, save money, and optimize your health coverage. From preventive services and wellness programs to the intricacies of high-deductible health plans, here are 13 things about health plans that you may not have known. These insights can help you maximize your benefits and make the most out of your coverage.

1. Preventive Care Is Often Covered at No Extra Cost

Most health plans cover preventive services like checkups, vaccinations, and screenings without requiring you to meet your deductible or pay out-of-pocket. This encourages people to seek preventive care, which can help identify health issues early, potentially avoiding more costly treatments down the line.

2. Telehealth Services Are Now a Standard Benefit

With the increasing demand for virtual healthcare, many health plans now offer telehealth services, making it convenient for you to consult with doctors and specialists from the comfort of your home. These services are often available at lower costs compared to in-person visits, making healthcare more accessible and affordable.

3. Flexible Spending Accounts (FSAs) Can Help Reduce Your Tax Burden

If your health plan offers an FSA, you can set aside pre-tax dollars to pay for eligible healthcare expenses, such as prescription drugs, medical equipment, and co-pays. This not only lowers your taxable income but also helps you budget for medical costs throughout the year.

4. Wellness Programs Can Provide Financial Incentives for Healthy Living

Many health plans include wellness programs that reward you for engaging in healthy behaviors. Activities like getting a flu shot, completing a health assessment, or participating in a fitness program can earn you incentives such as gift cards, premium discounts, or even cash bonuses.

5. Mental Health Services Are Often Included in Health Plans

With increased awareness of mental health, many health plans now offer coverage for mental health services, including therapy, counseling, and psychiatric care. Access to mental health support is essential for overall well-being and can be as important as physical health coverage.

6. High-Deductible Health Plans (HDHPs) Can Be Paired with Health Savings Accounts (HSAs)

HDHPs come with lower premiums but higher deductibles. To help cover medical expenses, they can be paired with an HSA, which allows you to save pre-tax money for medical costs. Funds in an HSA can roll over year after year, and even be invested, potentially growing your savings over time.

7. Out-of-Network Costs Can Add Up Quickly

While health plans provide some coverage for out-of-network services, they usually come with higher costs. It’s crucial to know which providers are in your network to avoid unexpected expenses. Some plans may also offer partial reimbursement for out-of-network providers but at a reduced rate.

8. Income-Based Discounts Can Make Health Coverage More Affordable

If you’re on a tight budget, you may be eligible for subsidies or discounts based on your income. These discounts can help reduce monthly premiums and out-of-pocket expenses, making health coverage more accessible for those with lower incomes.

9. Fitness Benefits Are Often Included in Health Plans

To encourage healthy living, some health plans offer fitness-related benefits, such as gym memberships, discounts on fitness classes, or reimbursements for exercise equipment. These perks help promote an active lifestyle, which can reduce healthcare costs in the long term.

10. Alternative Therapies Are Increasingly Covered by Health Plans

Coverage for alternative therapies like acupuncture, chiropractic care, and massage therapy is on the rise. These treatments are often included for managing chronic pain or stress and can be effective when combined with traditional medical care.

11. You Have the Right to Appeal Insurance Claim Denials

If your health insurance denies coverage for a treatment or service, you can appeal the decision. Understanding your rights and the appeals process can help you obtain coverage for necessary medical procedures or medications.

12. Some Prescription Medications May Be Covered at No Cost

Certain health plans cover generic or essential medications without any out-of-pocket costs, especially if they are preventive. Check your plan’s formulary to see if any of your medications are eligible for no-cost coverage.

13. Special Enrollment Periods Allow You to Change Plans Outside of Open Enrollment

Life events such as marriage, the birth of a child, or a change in employment status can qualify you for a special enrollment period. This lets you change your health plan or add coverage without waiting for the next open enrollment period.

Understanding the full scope of what health plans offer can empower you to make more informed decisions about your coverage. Whether it’s taking advantage of preventive services, exploring telehealth options, or utilizing wellness programs, being aware of these lesser-known benefits can help you get the most out of your health plan. Knowing the available features and options, you can optimize your coverage, reduce out-of-pocket expenses, and improve your overall health. In today’s complex healthcare landscape, being proactive about your health plan is more important than ever for achieving peace of mind and financial security.

Exploring the nuances of health coverage can help ensure that you and your loved ones are adequately protected. Stay informed, ask questions, and always review your health plan details to unlock the full potential of your coverage.